21 Nov VAT Registration

When do I need to register?…..How do I register?

When do I need to register for VAT?

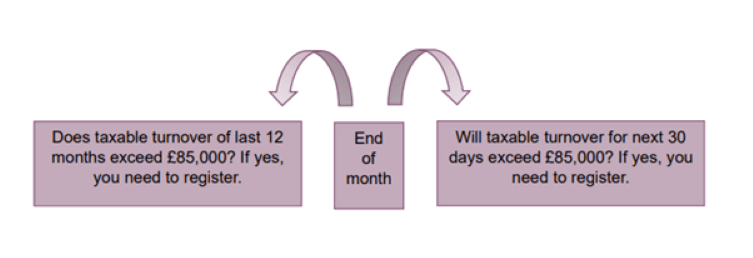

You must register for VAT where at least one of the following conditions is satisfied:

- At the end of the calendar month, the value of taxable supplies for the 12-month period ending at that time (or period of less than 12 months since starting the business) has exceeded £85,000.

Example

Between 1 July 2022 and 30 June 2023 your VAT taxable turnover is £100,000. That’s the first time it has gone over the VAT threshold. You must register by 30 July 2023. Your effective date of registration is 1 August 2023.

- If you expect that the value of taxable supplies for the next 30 days will exceed £85,000.

Example

On 1 May, you arrange a £100,000 contract to provide services. You’ll be paid at the end of May. You must register by 30 May. Your effective date of registration will be 1 May.

The term ‘taxable supplies’ includes supplies that would be taxed at the standard rate, the reduced-rate or the zero-rate. Exempt supplies (e.g. financial services, certain property transactions, insurance, health, education) can be ignored when calculating the VAT registration threshold.

Can I register if my turnover is below £85,000?

Yes…… you can voluntarily register for VAT. You may do this for a number of reasons, including:

- if registration is inevitable at some stage, early registration avoids the need to monitor turnover regularly;

- avoiding a penalty for late registration.

- having a VAT registration number can be important as a matter of image; and

- being able to recover VAT on certain costs. A person making supplies to taxable persons, who can recover any VAT charged, usually seek registration, so as to recover input tax on costs such as start-up costs.

However, there may be good reason for not registering for VAT, including:

- It increases prices which is a problem if customer cannot recover it; and

- You must submit VAT returns, which is an admin burden and can come with additional costs.

How do I register?

Registration may be made online via www.gov.uk/vat-registration/how-to-register.

You need a Government Gateway user ID and password to register for VAT. If you do not already have a user ID you can create one when you sign in for the first time.

As Agent I can also register you on your behalf.

What else do I need to consider about VAT?

There are several other things to consider which I cover in a number of other blogs:

- What VAT schemes are available?

- What is Making Tax Digital (MTD) for VAT?

- Can I claim VAT on preregistration expenses?